- The impact of wildfires, insecurity, and plantation conditions are some of the factors explaining the poor performance, according to Corma. Low prices and international competition also play a role, as noted by the Forestry Institute.

Chile's forestry industry is facing a complex moment in terms of investments, plantations, and employment. In the private sector, some admit the industry is stagnant, while Empresas CMPC warned months ago of a "retreat" in the sector due to wildfires, thefts, land seizures, and insecurity.

In this scenario, Arauco—the Angelini group—and CMPC—the Matte family—have driven investments abroad. They have plans for a $7.5 billion pulp project in Brazil, where they acknowledge strong support for their initiatives.

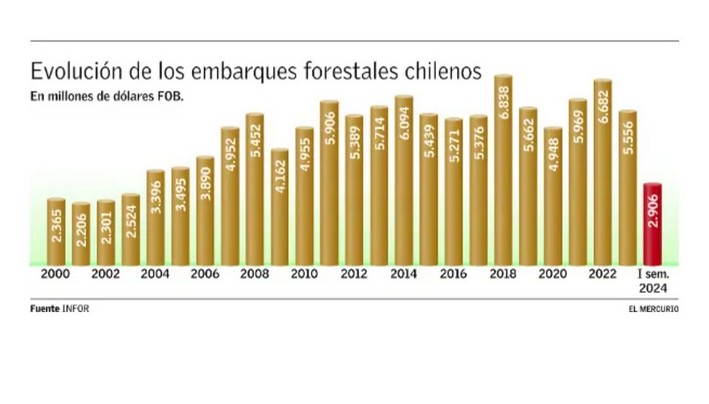

One indicator of the industry's declining strength is exports. These have stagnated over the last decade, failing to break the $6 billion ceiling. In contrast, during the previous decade—between 2002 and 2012—timber shipments more than doubled, rising from around $2.3 billion to nearly $5.4 billion, as shown by data from the Forestry Institute (Infor) under the Ministry of Agriculture.

"Today, the forestry industry is stagnant—even worse, it's shrinking painfully, especially among SMEs," says Juan José Ugarte, president of the Chilean Wood Corporation (Corma).

Regarding the growth of Chilean forestry exports between 2002 and 2012, Sandra Gacitúa, executive director of Infor, explains that it was driven by "strong demand for chemical pulp, particularly from markets like China." She adds that the price of this product rose during that period, from $382 to $719 per ton. She also notes that prices for sawn wood and panels climbed.

Ugarte, meanwhile, points out that "until 2012, Chile had an incentive law to help small landowners cover bare soils and create new forests. During that decade, the country planted an average of 50,000 hectares annually. In contrast, over the last 10 years, we’ve lost 350,000 hectares of forests." The Corma president argues that one reason for the export stagnation is linked to wildfires and the plantation deficit. "There’s a supply crisis, affecting the volumes of wood available for industrial processes and small-scale industry management," he states.

Ugarte notes there are currently 1.95 million hectares of plantations, far from the 2.4 million hectares the sector reached in previous years. "Some regions are heavily impacted by stalled economic activity, such as Maule, Biobío, Ñuble, and La Araucanía... Climate change goals call for adding at least 200,000 hectares by the end of this decade, but we estimate that a million hectares will be needed by 2050," he says.

The forestry association adds that over the last decade, 36,000 jobs have been lost in the sector, and 205 sawmills have closed. "It’s not just about exports—it’s a local social issue too," he adds.

Sandra Gacitúa explains that after 2012, shipments "stabilized," peaking at $6.838 billion in 2018. "This scenario is partly due to saturated international markets and falling prices for forestry products." She adds that "increased competition from other producer countries, like Brazil, has also affected export levels."

Regarding plantations, Infor’s executive director points to "a downward trend" in "the growth of new forested areas," due to wildfires and land conversion for other uses. "There’s also reduced investment in reforestation," she states.

Industry sources say some landowners lack the capacity to fund 20-year plantations amid high wildfire and vandalism risks.

Infor highlights a decline in wildfires during the 2023-2024 season. Gacitúa also notes that between 2012 and 2022, sawmills dropped from 973 to 851 due to "the aftermath of the subprime crisis, the pandemic, low technological renewal, raw material availability, and prices."

Projections

In the first half of 2024, forestry exports rose 4.9% year-on-year to $2.906 billion, per Infor data. Asked about year-end projections, Ugarte says, "We don’t see any significant change" compared to 2023, when shipments totaled $5.556 billion—a nearly 17% drop from 2022.

Sandra Gacitúa, meanwhile, states that "there’s moderate optimism that 2024 exports will surpass 2023’s," though she acknowledges the comparison baseline is low.

Despite the current industry outlook, Ugarte remains somewhat optimistic. He recounts that after a recent meeting with Economy Minister Nicolás Grau, a technical committee was formed to evaluate two measures. One is a $200 million forestry fund, to be deployed over four years, to kickstart a carbon credit market involving small and medium landowners to boost afforestation. The second, he says, is the government’s review of a BID initiative to promote wood construction, which would create "a buyer base" for the product.

Source: subscription edition ofEl Mercurio

Comentarios (0)

No hay comentarios aún. ¡Sé el primero en comentar!

Deja un comentario