In late September of this year, U.S. President Donald Trump announced a special 10% tariff on forestry imports. This is viewed with concern in Chile and especially in the Biobío region, given the importance of the timber industry present in the Region.

"According to the statement from President Donald Trump's administration, the current import scenario has ceased to utilize the productive capacity of the U.S. forestry industry, which also plays a key role in the activities of the military apparatus dependent on the Department of Defense—now the Department of War," contributed Andrés Acuña, director of the Master's in Applied Economics (MagEA-UBB) of the Department of Economics and Finance of the Faculty of Business Sciences at the University of Bío-Bío, who first analyzed the importance of the forestry sector in the Region's Gross Domestic Product within the context of reviewing potential future effects on the regional economy from new tariffs on the regional export sector.

Regional GDP

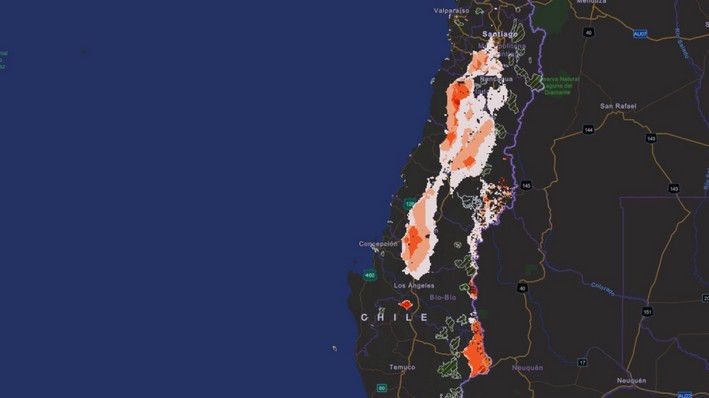

In more detail, the director of the Master's in Applied Economics (MagEA-UBB) indicated that according to information available from the National Statistics Institute (INE) and the Central Bank, "forestry sector exports from the Biobío region exceeded 3.6 billion dollars (MMUS$) in 2024, a figure equivalent to 18.2% of the Gross Domestic Product (GDP) of our region in nominal terms. In turn, in the January-July period of 2025, forestry exports from Biobío surpassed MMUS$ 1,700. Of the previous figure, over 20% was destined for the United States in 2024, while 37.3% of shipments went to China in the same year. By July 2025, the share of forestry shipments to the United States and China reached 23% and 31.2%, respectively."

In line with the above, Andrés Acuña highlighted that forestry sector exports to the United States "have significantly lost their relative importance since 2023 to date, a year in which they represented 37.5% of forestry shipments. This could be a sign that the U.S. construction sector is not prioritizing Chilean products as higher-demand inputs, or alternatively, the international positioning strategy of the local forestry sector has prioritized trade relations with the Asia Pacific, considering that South Korea was the third most important destination in 2024."

Regarding what a 10% tariff increase implies for the regional economy, the UBB FACE professor provided a relevant data point for analysis, explaining that, according to the statement issued by the White House on the past September 29th, there are significant national security reasons for limiting the import of wood, sawn wood, and its derivatives, based on the report prepared by the Department of Commerce on July 1st of this year.

As for potential projections, according to the director of the Master's in Applied Economics (MagEA-UBB), almost all forestry exports from Biobío will be affected by the new tariff measure. "However, I would be cautious in forecasting a completely negative scenario for the regional and national forestry sector, as the Federal Reserve (Fed) has indicated a bias towards lowering the interest rate for the remainder of the year."

"Regardless of the above, what is key, in my perspective, in this scenario of tariff uncertainty, is the willingness of our country's economic and trade authorities to proactively engage in negotiations with President Donald Trump's administration, in order to strengthen trade relations with one of our main partners and return tariff values to those established in the current Free Trade Agreement between both nations," he said.

On whether this increase in tariffs on forestry exports could be reflected in lower employment for the sector in the area, Andrés Acuña weighed that, if Biobío's forestry production is redirected to the Asia Pacific, "there would not be major changes in the sector's employment dynamics. However, it is important to note that the process of productive transformation of the sector towards incorporating new technologies linked to Industry 4.0 could reduce its structural capacity to generate new jobs in the medium/long term, which would eventually increase the unemployment rates of the regional manufacturing industry."

Low Impact

For his part, Dr. José Ignacio Hernández, academic of the Faculty of Economic and Administrative Sciences (FACEA) of the Catholic University of the Most Holy Conception (UCSC), stated that, regarding the impact itself, a 10% increase, considering the global context we are in today, is quite low. "If this had happened 10 years ago, a 10% increase is quite high, but considering the geopolitical context, where there are threats of even 100% or 150% tariffs, the relative impact or perception is that the increase can be contained."

Regarding how the effects of the new tariffs can be measured, the FACEA academic at UCSC expressed that it can be done "precisely, with what is called an input-output matrix, but at a regional level, where we can identify the inputs and outputs of different products up to the finished goods we could export and understanding how this could affect prices. The main difficulty is knowing how that 10% will transfer to all intermediate products or to the raw materials themselves, that is something a bit more complex and there are quite a few people working on that here in the Region."

Bad News

Renato Segura, economist from the Federico Santa María Technical University, explained that the measure represents "very bad news for an eminently forestry region, whose business model is oriented towards the export of wood and derivatives."

According to the academic, "the North American market represents around 20% of Chile's forestry exports, being the second destination after China, which accounts for nearly 40%." In that context, he adds that "the greatest effect will be concentrated in SMEs and forestry service companies, which show greater inelasticity of export supply in the face of price changes."

Segura warns that large companies in the sector, such as Arauco or CMPC, have a more resilient structure thanks to their geographical diversification: "some of their investments have been made on North American soil, which allows them to partially mitigate the impacts of the new tariffs." However, he emphasizes that "these changes will put a brake on the export dynamism towards the United States, which during 2025 had been around 10%, with consequences difficult to anticipate for a region already facing low performance in the manufacturing industry."

From the University of Concepción, the economist and director of the Department of Economics, Claudio Parés, called for observing the phenomenon "calmly." While he acknowledged that Biobío exports nearly 5 billion dollars in forestry products, he recalled that "only between 20% and 25% of those exports are destined for the United States."

"There could be an impact on the international price, but it should be less than 10%. In fact, most of the cost will be borne by North American consumers, who might see an increase in the domestic price of wood," explained Parés.

In the academic's view, "even if there is a slight drop in U.S. demand, protectionist policies are often accompanied by an internal boost to the northern country's economic activity, which could compensate for part of the initial decline."

Parés added that the final impact could be moderated by the diversification of export destinations and the high international competitiveness of the Chilean forestry sector. "Our industry is mature and will know how to adapt to new challenges, although this will inevitably impose some adjustment costs," he stated.

Trade Association

Through a public statement, the National Wood Corporation, Corma, indicated that in the face of the potential imposition of new tariffs by the United States on Chilean wood exports, from Corma we want to express our deep concern about the impact this measure could have on a sector already hit by a structural crisis.

The document also reads that beyond the bilateral aspect, "these measures will have global repercussions, as they alter the allocation of tariffs among different suppliers, with effects on the international wood market. This uncertainty will impact all types of companies, but mainly small and medium-sized ones, which do not have the backing to overcome these international difficulties and also face a declining domestic market scenario. The 169 formal sawmills closed in the last five years are clear evidence of the vulnerability faced by our small and medium-sized timber companies."

Another point contained in the statement indicates that "the fact that they define wood as a strategic sector and a matter of national security is not coincidental and is something Chile must not overlook. Our country needs to look at the forestry sector with the same relevance, understanding that - besides economic growth and job generation - this activity is key for the transition towards a low-carbon bioeconomy. Therefore, it is urgent to strengthen SMEs, advance policies promoting reforestation, and promote new uses of wood, in construction, biomaterials, and bioproducts, in line with the country's climate commitments. Only with a long-term vision can we sustain our SMEs and ensure that the forestry industry continues to be an engine of employment, innovation, and sustainable development for the country."

Source:Diario Concepción

Comments (0)

No comments yet. Be the first to comment!

Leave a comment