The U.S. market for forest products is enormous: in 2024 alone, according to data from the International Trade Commission (USITC), imports reached $46.947 billion, as reported by Infor. However, this trade is not balanced: the U.S. has a trade deficit of $-14.824 billion in this sector, particularly concentrated in products under Chapter 44 of the Harmonized System ("Wood and articles of wood"), with a negative balance of $-13.672 billion.

The deficit in Chapter 48 ("Paper, paperboard, and articles thereof") adds another $-4.640 billion, while only Chapter 47 ("Wood pulp or other fibrous cellulosic material") shows a surplus of $3.488 billion.

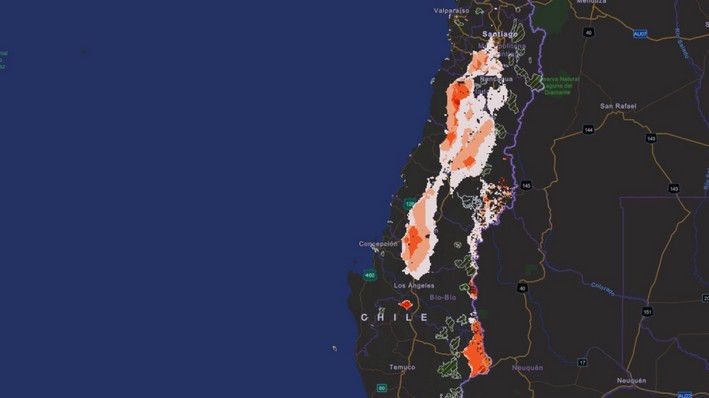

For Chile, this scenario is relevant. Although the country ranks only ninth among the main suppliers of forest products to the U.S., with a 2.4% share (below giants like Canada, China, and Brazil), any changes in trade rules or increased tensions due to the U.S. government's trade war could directly impact Chilean exports.

The U.S. dependence on imported wood and wood products is not new but has intensified in recent years, especially after the pandemic. The structural deficit in wood and paper reflects an opportunity for Chilean exporters but also a vulnerability: protectionist measures, tariffs, or restrictions could severely disrupt trade flows.

In this context, Chile must monitor how U.S. trade policy decisions evolve—not only because this market represents a significant export window but also because global competition is fierce. Canada dominates with 42.4% of the market, leaving other competitors, including Chile, with much narrower margins.

The challenge for Chile is clear: diversify markets, increase the added value of its forest products, and position itself strategically in an international landscape currently marked by uncertainty.

Comments (0)

No comments yet. Be the first to comment!

Leave a comment