Coinciding with the recent change in the Ministers of Finance and Agriculture, the general manager of CMPC, Francisco Ruiz-Tagle, spoke with "El Mercurio." The top executive of La Papelera—linked to the Matte group—addressed these adjustments in the Government and the company's performance amid lower pulp prices and global tariff uncertainty.

He also updated plans in Brazil with its US$4.5 billion Natureza pulp project and the environment in Chile for new investments. The latter comes during an election period and with the lingering burden of insecurity and obstacles to incentives for investments in the forestry sector.

—How do you analyze the departure of Mario Marcel from the Ministry of Finance?

“Mario Marcel is a great economist and was a very relevant minister for this government. We are all quite surprised by his departure; at least, I did not expect it.”

—How do you see the economic challenges from now until March with Minister Nicolás Grau in Finance and the challenges in the forestry sector under the new Minister of Agriculture, Ignacia Fernández?

“We trust that Minister Fernández will move forward with the forestry plantation incentive project that the Ministry of Agriculture is working on. Because if we want to talk about growth, this is a sector with potential, highly demanded products, and high impact on activity and employment from Maule to Los Lagos. We hope these will be concrete measures and that the suggestions presented by timber associations will be taken into account.”

“With Minister Grau, we have also been working on formulas to incentivize plantations, leveraging their carbon absorption capacity, so we trust these efforts will now also have support from Finance.”

—What is the economic balance for CMPC this year amid lower pulp prices and tariff tensions with the U.S.?

“This has been a year of significant challenges for the industry. The tariff issue has caused market distortions and uncertainty in several of them. Additionally, some economies have weakened, for example China, which is very relevant for the development of Chilean exports.”

“Regarding tariffs, Chile remains in a position no worse than the main countries we compete with. For example, we ended up with a 10% tariff on pulp.”

—In 2023, in the U.S., you allocated US$40 million to the purchase of Powell Valley, dedicated to wood remanufacturing products. Are there new steps in that country?

“We have taken another step to increase the production capacity of what we purchased. Powell Valley has about 30,000 cubic meters of production capacity and will exceed 50,000 cubic meters. So, we took a step in terms of investment—US$20 million—to increase our share in wood finishing products.”

Electoral Environment

—It has been four months since Bernardo Larraín Matte assumed the presidency of CMPC. Has there been any change?

“Bernardo has had a very distinguished career at the helm of Colbún, where he was general manager, vice president, and president. Additionally, he had significant guild experience leading Sofofa. At CMPC, he joined the board in May 2021 and later became vice president, until he began serving as president in April of this year. He knows the company very well. Undoubtedly, he is making an important contribution to the development of CMPC, particularly with the 2030 strategy we have defined. He understands the forestry sector as an important source of development for Chile.”

—How do you envision local forestry development in the current electoral scenario?

“There is something very interesting. There is a special alignment in Chile, among practically all candidates and the programs we know, on the importance of returning to growth, something that had been somewhat dormant for some time. I highly emphasize that candidates are in favor of growth, and the forestry industry is incorporated as one of the engines of growth.”

—How do you see the future if the ruling party wins, whose presidential candidate is from the Communist Party?

“Rather than giving a political opinion, I can say that the company makes decisions beyond the political situation; it looks at the long term. Consider that a forestry rotation lasts 20 years, meaning several governments. So, decisions are made for the long term... We have invested in Brazil under left-wing governments as well. We invest under right-wing governments. So, I would say the company’s view in that sense is somewhat agnostic. What does concern us is that the government in power is pro-growth, pro-investment, and supports equitable and comprehensive economic development in Chile.”

Chilean Forestry Potential

—What is the real relevance of the forestry industry in Chile today?

“First, it is a super relevant, powerful sector in generating activity and employment in the places where it operates... It is an industry that generates over 300,000 jobs and could be much more if it had growth. Second, Chile is a very competitive forestry country. We have the most competitive long-fiber or pine production globally. This is used to produce packaging boxes, cardstock, printing papers. And in eucalyptus, Chile is the second most efficient producer in the world, after Brazil.”

“Third, the industry has products that are very much in demand today. Wood replaces fossil fuels, forests are renewable, and their products are biodegradable and recyclable... The fourth aspect is that in Chile, we also have the possibility to increase the existing forest mass, I mean both forest plantations and natural forests.”

—Are there lands for the sector to grow in Chile?

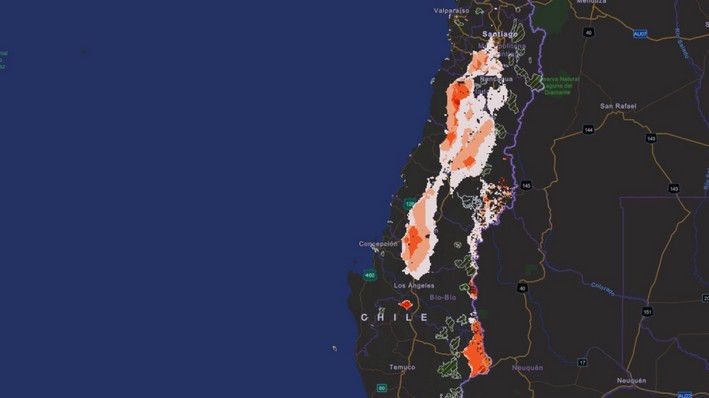

“Chile has lands that are in the process of degradation or erosion, estimated at about two million hectares that could be planted... To meet the carbon neutrality goal, the country would need to plant at least an additional 900,000 hectares. It is a significant amount that could be added to have a more robust forestry sector.”

“Now, for there to be enabling conditions to invest in Chile, it is evident that, for example, security issues must be resolved, and forest mass must be increased to allow production. I am not referring to the forest mass of large companies, but to having proper incentives for small producers, who number around 25,000. Today, there are just under two million hectares planted. At one point, it was 2.3 to 2.4 million. We are at levels similar to the 1990s.”

—With those hectares, is there no more space for new plants in the country?

“No, there is no possibility....”

—Has the incidence of insecurity decreased or is it still strong?

“Insecurity has seen a correction in recent years. The 2023 wood theft law had a very positive impact in reducing attacks, but they have still continued. It is unacceptable to have even one attack. We have recently had attacks in some places. The security issue is fundamental.”

Advances in Brazil

CMPC produces approximately 4.5 million tons of pulp. Brazil accounts for about 2.4 million and is larger than Chile. With the Natureza project, Brazil would increase to 4.8 or nearly 5 million tons.

—Is the balance in pulp shifting to Brazil because you cannot invest in Chile?

“If the question is, would you invest in Chile? I tell you, definitely, we would invest in Chile. But it requires those conditions we talked about. I would summarize it in two things: security, along with having more forest mass, and the other is having the proper permits to incentivize investments in Chile. If the conditions are there, Chile can be a more relevant forestry country than it is today.”

—What is the status of the Natureza project in Brazil, the construction of the US$4.5 billion pulp plant?

“It is a 2.5 million ton project in Rio Grande do Sul. The location where it will be installed is near the current plant (Guaiba), which is interesting from a synergy perspective.”

“We have approved a first stage called terms of reference, which is very relevant. It is the initial knowledge of the authority regarding the project. There is no detailed engineering at that point, but rather a description of the initiative, its location, and size. It is very relevant because at that point, there is already feedback from the Brazilian authority.”

“Then comes a very important phase called preliminary license... It is a very advanced point on the path to approval, which should be ready between November or December of this year. Then, we expect the installation license, which is the definitive approval for construction, which would be during the first quarter of next year.”

—And when would CMPC’s board approval occur?

“This has not been sanctioned by the board, which obviously knows the project very well. It will be once the permits are obtained. That would be during the first half of next year.”

“This (authorizations) in Brazil is fast... As I said, for there to be more investment in Chile, there must be forests, improved security, and on the other hand, a project approval and permit system that is also very efficient and connected with whoever wants to invest.”

—Does the threat of a 50% tariff announced by the U.S. against Brazil cause concern for you in Brazil?

“No, because the U.S. concluded that it does not apply to pulp, which was exempted from the 50%.”

—How many people would work on the construction of Natureza and then in its operation?

“In construction, it should be around 10,000 people. And in operation, about 1,500 with permanent jobs.”

—Are you looking at financing for that project?

“We are already studying plans. This is a very responsible company regarding the management of its balance sheet and debt. It is still in the process of defining how that financing combination will be. But we view it with great calm.”

Source:El Mercurio

Comments (0)

No comments yet. Be the first to comment!

Leave a comment